Buy Gold Bars

Explore our selection of buy gold bars, offering trusted quality, transparent pricing, and global delivery options.

As established gold dealers we are able to offer low premium gold bullion bars from 1% over the market spot price. Suisse Gold offers its clients a range of products, including Argor Heraeus, Austrian Mint, Credit Suisse, Johnson Matthey, PAMP Suisse, UBS, Valcambi, and others. London Bullion Market Association (LBMA) approved bullion bars are also available at low premiums. Clients may purchase gold for delivery or secure vault storage. We also buy gold bullion back from our clients. Gold bars may be purchsed in 15 currencies and using cryptocurrencies.

Why Invest in Gold Bars?

Gold has acted as a currency for thousands of years. It is coveted by governments, banks and investors. The metal has facilitated trade and acted as a store of value to many empires, including the Roman Empire, the Egyptian Empire, the Ottoman Empire and the British Empire.

One of the most important things to consider for investors new to buying gold bars, is that gold retains its value. What this means is that the purchasing power of gold remains consistent. A British Sovereign coin, which consists of 7.3 grams of gold, could purchase a very nice suit 150 years ago, and it still can today. By contrast, it is unlikely that €500 today will have the same purchasing power in 100 years. Governments print money, which leads to inflation, which reduces the value of the money. However, gold cannot be printed, and this means that its value cannot be manipulated by governments the same way.

Another important consideration for new gold investors is that gold bars can act as a hedge against a recession or poor economic conditions. The gold price does not correlate to the stock market or the economy. When the economy is doing well, gold tends to be undervalued. When economic conditions turn bad, or a country hits a recession, the gold price goes up. People lose faith in the value of their fiat currency, and turn instead to gold bars and coins.

Holding a diversified portfolio is the best option for any investor, and holding 10-20% of your savings in gold bars or precious metals is considered a good way to diversify a portfolio beyond the stock market.

Gold bars maintain their value and are recognised worldwide. In times of severe economic downturn, you can rely on gold bars or coins as a source of money, and use them to buy food or services if necessary.

Finally, gold bars may be held outside the banking system. In the economic recession of 2011, the government of Greece froze all citizen's bank accounts and only allowed for very limited withdrawals. The government of Cyprus also froze many of the larger accounts, and issued an emergeny tax on any large accounts. Individuals holding money in accounts in these countries lost control of their savings. This is not likely to happen if you hold gold bars, as there is no legislation stating that gold bars need to be reported in the same way that bank accounts do.

The Difference Between Gold Bars and Gold Coins

For clients looking to purchase gold, both bars and coins are a good option. All gold coins are issued by official government mints, and have a legal tender value. However, coins are mostly available in a 1 Oz denomination, and fractional denominations. Coins also sell for a higher premium than gold bars, as they cost more to manufacture.

Gold bars are available in a much larger range of sizes, from 1 gram to 1 kilogram. This can be beneficial for individuals looking to place larger amounts of money into gold bars. Gold bars also sell for a lower premium to coins of a similar size. Gold bars are manufactured by refineries. Many of those sold by SuisseGold.com are manufactured in Switzerland, by the 4 major Swiss refineries. Some government mints, such as the Royal Canadian Mint and the Royal Mint (UK) also release a gold bullion bar for investors.

Gold Bars By Manufacturer

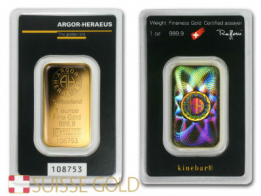

Argor-Heraeus

Argor-Heraeus is one of four major Swiss precious metals refineries, located in Ticino, the Italian part of Switzerland. The refinery manufacture gold bars in sizes ranging from 1 gram to 1 kilogram for bullion investors. Argor-Heraeus is most famous for its 'Kinebar' design. A 'kinebar' is a laser inscribed image located on the back of a gold bar, that is impossible to replicate.

Argor-Heraeus also manufacture gold bullion bars for the Austrian Mint, UBS and Raiffaisen bank. The Austrian Mint and UBS sell a kinebar design as well as an original gold bullion bar.

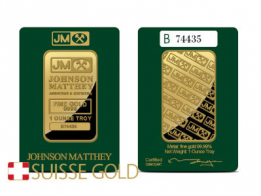

Asahi

Japanese company Asahi recently bought Johnson Matthey, and took over their refining business in Utah. Asahi manufacture gold bars primarily for larger investors and banks, but their premiums are competitive and work consideration for investors. Asahi gold bars are LBMA approved.

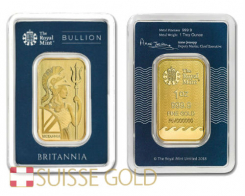

Royal Mint

The Royal Mint in England recently launched their first gold bar, the Britannia Gold Bar. The Royal Mint is more famous for their gold sovereigns and Britannia gold coins. The Britannia gold bar is a beautifully designed gold bar that has become a favorite of gold investors and collectors.

Credit Suisse

Credit Suisse gold bars are manufactured by Valcambi on behalf of the bank. They were first launched when Valcambi what wholly owned by the bank. Credit Suisse was the first bank to launch a range of smaller gold bars for its retail clients, and the bars were an instant hit. Today, Credit Suisse gold bars are the most popular gold bars available to investors worldwide. Credit Suisse gold bars are available in sizes from 1 gram to 1 kilogram.

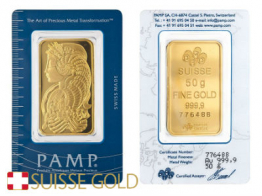

PAMP

PAMP is one of Switzerland's four major refineries, and has long been at the forefront of the industry in innovation. The brand was the first to release a gold bar with an artistic design on it - the PAMP Fortuna bar, which was released in gold, silver, platinum, palladium and rhodium. PAMP gold bars are available in a range of styles, from cast gold bars, to the lunar and faith series.

Valcambi

Valcambi gold bars are manufactured in the Italian part of Switzerland, and are a favorite among European investors. These bars sell at very competitive premiums, and are manufactured to a very high standard, making them an excellent option for investors.

Royal Canadian MInt

The Royal Canadian Mint manufacture gold bars primarily for larger investors. They do not offer a range of bars below a 1 Oz size. However, their premiums are highly competitive and all bars available are manufactured to a fineness of 99.99. The Royal Canadian Mint is most famous for its Maple Leaf series, and it has recently released a 1 Oz Maple Leaf gold bar for bullion investors who prefer bars over coins.

Perth Mint

The Perth MInt is most famous for its collectible coins, but they sell a range of Kangaroo bars which are popular with investors. Perth gold bars are available in a range of sizes, but the most popular are the 1 Ounce and 10 Ounce gold bars.

Storing Gold Bars in Switzerland

One major consideration for many investors looking to buy gold bars is how to store them. SuisseGold.com offers its clients an excellent solution. Gold bar storage in Switzerland, outside of the banking system, starting at just 0.5% per annum. SuisseGold.com offers secure vault storage located in Zurich, and clients have the option to store their gold bars for up to one year free of charge. Clients may, at any time, sell their bullion back to SuisseGold.com at favorable rates, collect it, or arrange for it to be delivered. All gold bars are stored outside the banking system, and do not carry reporting requirements - this means that SuisseGold.com is not obligate to report its client's bullion holdings to any government authorities. This is particularly relevant to clients who are concerned about having access to their money in the event of a recession.

How to Buy Gold Bars

Clients of SuisseGold.com may buy gold bars in any of 15 currencies, including EUR, CHF, GBP, USD and many others. Clients also have the option of paying with Bitcoin. Gold bars are allocated to client accounts or shipped as soon as payment is received.